My name is Sophie. I study social anthropology and film at St Andrews University. I’m an aspiring writer and journalist.

Weekly Musings

History Revisited

(August 21st, 2024)

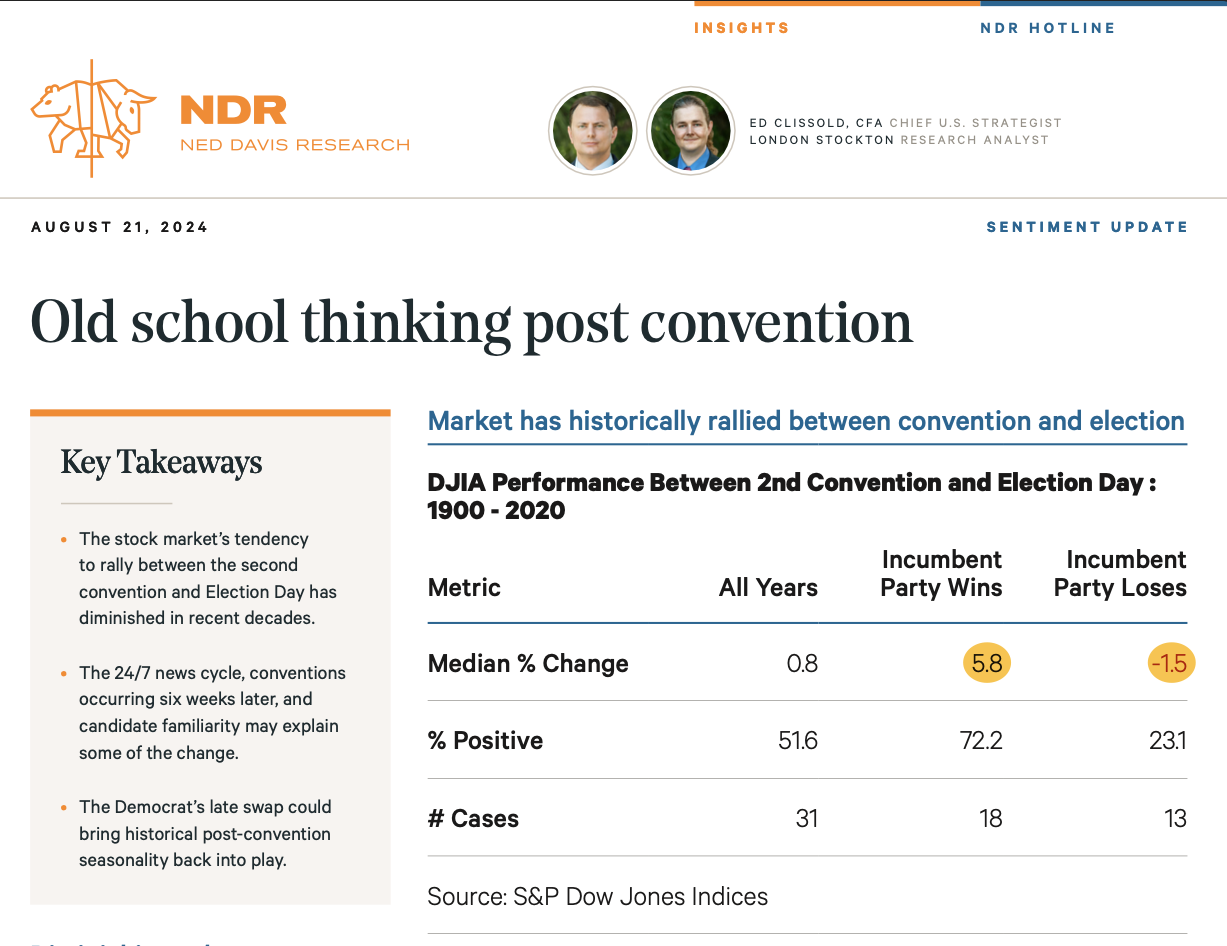

With Biden dropping out of the race in the blink of an eye, investors have just a few months to gauge market trends. According to Ned Davis Research, the media has simplified the market rallying process for investors between the second convention and Election Day. The public is able to familiarize with candidates over a prolonged period of time, unlike the exposure sixty years ago. The stock market benefits from an extended time frame. Analysts have greater insight into market trends. Markets require a level of certainty to rally. With Biden getting swapped out for Kamala so suddenly, this certainty is removed. Now, investors face a pressed time frame to make these decisions. In earlier decades, the public had less time to assess candidates. Markets rallied between the second convention and the day before the election. Could we be entering a nationwide case of deja-vu? Today’s incumbent party candidate is less known than the challenger. Kamala Harris has not been featured in the media to the extent that Biden is. Investors have not been this pressed for time in the election process since 1964. There is a risk of analysts not being equipped for this pressure. It will be harder to predict the incumbent party’s impact on markets. According to trends, DJIA percentages rise when the incumbent party retains presidency. It can no longer be promised that the stock market will benefit from this.